What is a donor advised fund (DAF)?

Donor Advised Funds

A Jewish Foundation Donor Advised Fund makes it easy to manage your philanthropy with as little as $5,000 to start. It allows you to make charitable contributions and realized significant tax advantages, when the time is right for you. Once established, you, your family or anyone you designate may recommend that distributions be made from the fund to Shalom Austin and almost any other qualified charitable recipient, Jewish or non-Jewish, local or otherwise, at any time.

Benefits:

- Income tax charitable deduction for any year in which contributions are made to the fund

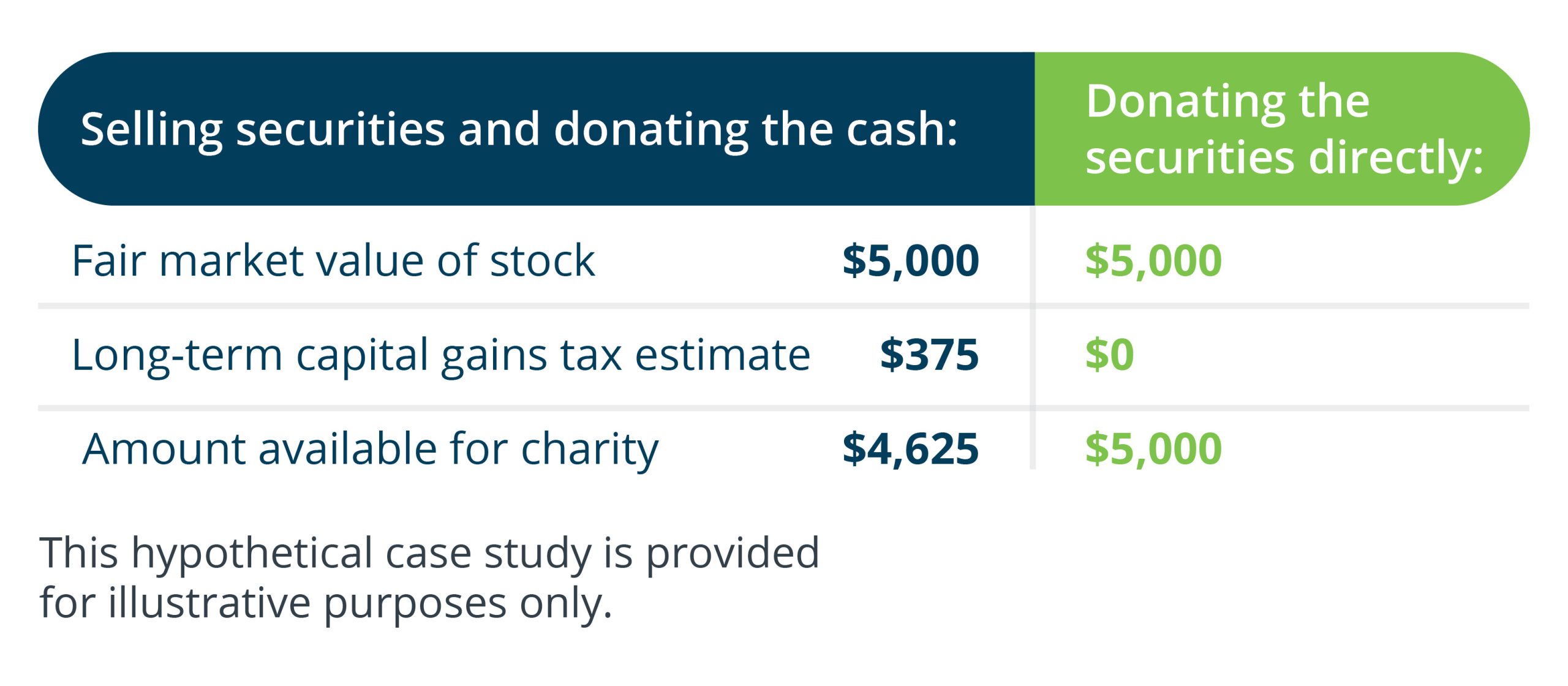

- Savings on capital gains taxes by funding the Donor Advised Fund with appreciated assets

- Convenience of having all of your giving consolidated into one account that’s accessible through a secure online portal

- Your giving is in the name of the Jewish community

- Opportunity to involve your entire family

Questions? Interested in learning more? Please contact us at foundation@shalomaustin.org.

The Jewish Foundation and DAFs

WHAT IS A DONOR ADVISED FUND?

You can create a Donor Advised Fund (DAF) using a variety of sources including check, credit card, stock transfer, and liquidation of other assets and then over time, you can distribute (aka grant or gift) those funds to multiple qualified organizations at your convenience. A good analogy is to think of your DAF as your “charitable giving checkbook.” You can also choose to spend a portion of your fund and endow a portion to sustain your philanthropic goals in permanence. You can choose to make your children successor advisors or leave the remainder to any organization, including Shalom Austin.

What is the Shalom Austin Jewish Foundation?

The Shalom Austin Jewish Foundation serves as a center for Jewish philanthropy by partnering with donors & community organizations to fulfill their philanthropic goals and to secure the Jewish community now and in perpetuity. Through planned giving and endowment development, the Jewish Foundation makes a lasting impact in the name of the Jewish community, at home in Austin and around the world. The Jewish Foundation was established in 2014 and at the end of 2023 had assets valued at over $16M.

What is the Jewish Foundation’s relationship with Austin Community Foundation?

The Jewish Foundation funds are administered in partnership with the Austin Community Foundation (ACF). The funds are held and managed by ACF, representing more than 50 years of established success in fostering philanthropy, ensuring your investments flourish and make a meaningful difference in the programs and traditions you value most, now and forever. ACF stewards more than $500 million in assets in approximately 1,300 charitable funds.

How Does It Work?

DO ALL GIFTS NEED TO BE GIVEN TO JEWISH ORGANIZATIONS?

No. You can select any non-profit organization that reflects your values and charitable interests.

Grants can only be awarded to non-profit, charitable organizations, governmental entities (e.g. University of Texas), or a religious institution. Jewish Foundation funds are prohibited from lobbying and political activities. Grants may be made to any nonprofit in the United States and, with some additional administration, to international organizations.

CAN MY CHILDREN RECOMMEND WHERE THE MONEY GOES?

Yes. You can name your children as advisors for part or all of your funds. The Jewish Foundation encourages this opportunity for a family dialogue about the kind of legacy you want to leave and how your children can help shape it. Shalom Austin professionals can help you explore the options for intergenerational legacy planning, to find the best solution for you and your family.

HOW DOES THE JEWISH FOUNDATION MANAGE MY FUNDS AND INVESTMENTS?

Donors select from several investment options, ranging from long-term active to mid-term passive management. Any earnings from your investment stay in the fund, allowing for more money to be granted to the organizations you choose to support. The funds are managed by ACF’s highly experienced investment counsel firm and overseen by a committee of seasoned investment and business professionals drawn from ACF’s Board of Directors and the larger business community. The Jewish Foundation Committee monitors fund performance regularly. There is also an option to “not” have your funds invested. Please refer to the Investment Options sheet for additional details.

ARE MY TRANSACTIONS WITH THE FOUNDATION CONFIDENTIAL?

Absolutely. If a donor wishes to remain anonymous, the Jewish Foundation and ACF will not share your information with any organization. As administrators of the fund, select ACF and Shalom Austin professionals to see a record of your donations.

How Do I Make It Happen?

WHAT IS THE MINIMUM AMOUNT TO SET UP A FUND?

To create a Donor Advised Fund, a minimum of $5,000 is required. The minimum recommended balance is $3,500.

CAN I GIVE ASSETS OTHER THAN CASH TO A FUND?

Yes. You may contribute stock, mutual fund shares, and, in many cases, privately held stock, real estate or other tangible property. ACF will sell the asset based on their policies.

WHAT IF I MOVE TO A DIFFERENT CITY OR STATE? IS THIS ONLY FOR AUSTIN, TX?

You do not need to be a resident of Austin to have funds with the Jewish Foundation.

SHOULD I TALK TO MY LAWYER AND ACCOUNTANT?

We strongly recommend that you consult with your own professional advisors regarding your planned giving, especially as it relates to tax deduction rules (and itemization). If you are using an asset other than cash to create or contribute to your donor advised fund, we are happy to work with you and your advisor to facilitate the transfer of assets.

DOES IT MAKE SENSE TO CLOSE A FUND AND, IF SO, HOW AND WHEN CAN I CLOSE A FUND?

Contributions to a DAF are irrevocable gifts. All money in the fund must ultimately be held for or disbursed to qualified public charities. If you make grant requests equaling the entire balance of the DAF, once the balance is $0, if you don’t replenish or add more funds to it, the fund will close.

In What Ways Can I Use My Donor Advised Fund?

MAY I PAY FOR MY JCC MEMBERSHIP OR A FUNDRAISING GALA FROM THIS FUND?

If your JCC membership entitles you to a material benefit (one that is more than incidental) – like health club privileges or other goods or services – it would be unlawful for that membership to be paid from a DAF, and ACF will have to deny the request. Similarly, the fund cannot pay for a fundraising event for your favorite charity’s annual gala if a meal or other more than incidental benefit is conferred.

MAY I PAY FOR MY SYNAGOGUE DUES?

This is the exception to the membership rule. Because no physical goods or services are exchanged for your dues, they can be paid out of a DAF.

WHAT INFORMATION IS PROVIDED TO AN ORGANIZATION WHEN THEY RECEIVE A GIFT (GRANT) FROM YOUR FUND?

In addition to the check or electronic payment, a cover letter will be sent to the organization notifying them that the donation came from your Jewish Foundation fund and providing your name and address. If you choose to remain anonymous, the letter will state that the donor wishes to remain anonymous. More often than not, the organization receiving a grant from your fund will send you a thank you note acknowledging their receipt of the gift, but you do not need to save these letters for tax purposes. The only documentation that pertains to your taxes is when you add to your fund (when you establish it and if you replenish it).

Jennifer Kohn Koppel

Foundation Director & Philanthropic Advisor

O: (512) 497-5402

jennifer.koppel@shalomaustin.org

CONTACT US

HEALTH & WELLNESS

Fitness

Swimming

Tennis & Pickleball

Sports

EDUCATION

Jewish Culture & Education

Early Childhood Program Preschool

After School & Childcare

Camps

ARTS & CULTURE

Literary Arts

Visual Arts

Theatre & Film

Dance

COUNSELING & SUPPORT

Jewish Family Service

Counseling & Groups

Case Management

References & Resources

Copyright Shalom Austin 2025. Privacy Policy.