Helpful Year-End Links for Jewish Foundation Fundholders

For ACH/Wire Transfer or Stock Transfer instructions or any questions, email us at [email protected]

Simplify Your Giving. Maximize Your Impact.

The Shalom Austin Jewish Foundation helps sustain a vibrant and secure Jewish community, now and for future generations. Guided by Jewish values and the individual interests of donors and organizations, the Foundation provides an opportunity to make a lasting impact through philanthropy in the name of the Jewish community, at home in Austin and around the world.

My family and I created two funds through the Jewish Foundation. During the last ten years, I’ve watched my daughter, her husband and my grandchildren become huge beneficiaries of and participants in this very special community. So, it was just natural for me to want to help sustain the momentum that has been built here over the years and help create and grow a Jewish legacy for those who will follow.

Marvin Brittman, Jewish Foundation Fundholder and Committee Member

Gift Options

Gifts to the Jewish Foundation can be made outright during your lifetime or through a planned giving vehicle. Find out what types of assets make the best planned gifts to create your Jewish legacy.

BEQUESTS

Bequests provide permanent resources for the Jewish community, perpetuating your beliefs for generations to come.

- Can be established in your will or through a trust

- May be made in any amount- no matter how large or small

- May provide your estate with a tax deduction

- Make a significant, lasting gift without affecting your finances during your lifetime

It is one of the easiest gifts to make as a part of your estate plan. The amount can be specified in dollars or percentage of your estate.

Please email [email protected] for more specifics regarding bequest language.

Appreciated Assets

Donating appreciated securities, including stocks or bonds, is an easy and tax-effective way for you to make a gift to the Jewish Foundation.

- Avoid paying capital gains tax on the sale of appreciated stock held for over one year

- Receive a charitable income tax deduction

- Gifts can be timed to match fluctuations in the market

- Support the causes you care most about today

retirement assets

Donating part or all of your unused retirement assets, such as your IRA, 401(k), 403(b), pension or other tax-deferred plan, is an easy and tax-effective way to make a legacy gift. Your heirs may receive only a fraction of the plan’s value, as inherited retirement plan assets are subject to both estate and income taxes.

- Heirs avoid paying estate and income taxes on the assets left in your retirement account

- Easy to create and modify using the beneficiary designation form

- Through the IRA Charitable Rollover, a direct distribution to your legacy commitment at the Jewish Foundation does not trigger income tax for you if you are 70 ½ or older.

Life Insurance

Life insurance is an excellent way to create your Jewish legacy. You can donate a paid-up whole life insurance policy you no longer need or purchase a new policy or additional policy and name the Jewish Foundation as owner and beneficiary. Purchasing an additional or new policy can enable you to substantially increase the potential amount of your donation while enjoying attractive tax advantages.

- Premiums paid on policy owned by the Jewish Foundation are tax-deductible

- Easy to arrange and administer

If you have a life insurance policy that has outlasted its original purpose (ie: you purchased a policy to provide for minor children that are now financially independent adults), consider funding your legacy with this gift. For new policy purchases, the reasonable cost and tax benefits make this choice particularly appealing for younger donors. Contact us at [email protected] for sample life insurance quotes.

REAL ESTATE

Donating appreciated real estate, such as a home, vacation property, undeveloped land, farmland, ranch or commercial property can make a great gift to the Jewish Foundation.

- Avoid paying capital gains tax on the sale of the real estate

- Receive a charitable income tax deduction based on the value of the gift

- Leave a lasting legacy

Your real property may be given to the Jewish Foundation, via Austin Community Foundation, by executing or signing a deed transferring ownership. Your gift will generally be based on the property’s fair market value, which must be established by an independent appraisal.

CASH

A donation of cash is a simple and easy way for you to make a gift.

- You can make an immediate impact

- You can take a charitable income tax deduction

OTHER WAYS TO GIVE

There are additional ways to make a planned giving, including charitable remainder trusts and charitable lead trusts. Additionally, planned gifts can be a combination of gift options to best met your financial goals.

To establish a fund or for more information about planned giving, please contact us at [email protected].

Donor Advised Funds

A Jewish Foundation Donor Advised Fund makes it easy to manage your philanthropy with as little as $5,000 to start. It allows you to make charitable contributions and realized significant tax advantages, when the time is right for you. Once established, you, your family or anyone you designate may recommend that distributions be made from the fund to Shalom Austin and almost any other qualified charitable recipient, Jewish or non-Jewish, local or otherwise, at any time.

Benefits:

- Income tax charitable deduction for any year in which contributions are made to the fund

- Savings on capital gains taxes by funding the Donor Advised Fund with appreciated assets

- Convenience of having all of your giving consolidated into one account that’s accessible through a secure online portal

- Your giving is in the name of the Jewish community

- Opportunity to involve your entire family

Questions? Interested in learning more? Please contact us at [email protected].

Fund Types

The Shalom Austin Jewish Foundation provides a variety of products and services to fit your philanthropic goals.

Shalom Austin Annual Campaign Endowment

A Shalom Austin Annual Campaign Endowment demonstrates your belief in the continuity of Jewish life for generations to come. Your philanthropic investment and leadership in Austin will continue to care for Jews in need, ensure a vibrant Jewish future in Central Texas, and strengthen Israel and our global Jewish community in perpetuity.

This fund is established at our Jewish Foundation in your name to support the breadth of programs, services, and community funding provided by Shalom Austin.

Designated Funds

A designated fund is a charitable vehicle that allows individuals, families, organizations, or small groups to raise funds in support of a specified non-profit organization. All distributions from a Designated Fund are made to specified organization(s) identified at the time the account is established.

Designated funds are great when you know exactly which nonprofit(s) you would like to support, and do not wish to be actively involved in grantmaking. Additionally, designated funds are a successful way for you and/or your family to leave a legacy gift supporting specific organizations you care about. Once you establish a designated fund, grants are made regularly to the nonprofits you’ve specified. The funding provides the nonprofit with a sustainable and dependable source of support. Funding is dependent on the type of fund, amount in the fund and a schedule you create when the fund is established.

Shalom Austin Annual Campaign Endowments are a type of designated fund.

Field of Interest Funds

Field of interest funds allow a donor or group of donors to establish a fund that addresses issues of specific interest to them. To establish this type of fund, donor(s) set the grantmaking parameters and then either establish an advisory committee or allow the Shalom Austin Grants Committee to make grant decisions.

The Jay Rubin Israel Experience Fund, which provides funding for trips to Israel and community-wide programs that promote understanding of Israel through travel and other experiences, is an example of a Field of Interest Fund.

Agency Funds

By choosing to establish a nonprofit fund at the Shalom Austin Jewish Foundation, you are helping to create a meaningful and long lasting impact in our Jewish community, while gaining access to world-class investments services by our fiscal partner, Austin Community Foundation (ACF). ACF currently manages funds for over seventy nonprofits across Central Texas. There are two types of agency funds; either one that is permanently endowed or one that is quasi-endowed.

The Congregation Beth Israel Permanent Endowment Fund is an example of an Agency Fund.

DONOR ADVISED FUNDS

A Jewish Foundation Donor Advised Fund is a kind of “charitable bank account” you can establish with as little as $5,000. It allows you to make charitable contributions and realized significant tax advantages, when the time is right for you. Once established, you, your family or anyone you designate may recommend that distributions be made from the fund to Shalom Austin and almost any other qualified charitable recipient, Jewish or non-Jewish, local or otherwise, at any time.

To learn more about establishing an endowment fund, including fund minimums, gift options, and associated fees, please contact us at foundation@shalomaustin.org. The Shalom Austin Development Department is happy to work with you to fulfill your Jewish legacy!

Shalom Austin Jewish Foundation takes its stewardship responsibility very seriously with their strong investment oversight and retention of professional investment advisors. Our assets are appropriately allocated, monitored and regularly reviewed. Being part of Shalom Austin further unites us in community and passion for our shared causes.

Jennifer Failla Hoffman, Shalom Austin Women’s Philanthropy Legacy Giving Co-Chair

Read About the Foundation on the Jewish Outlook Blog

Estate Planning with a Donor Advised Fund

A Donor Advised Fund (DAF) is a philanthropic tool that simplifies your charitable giving during and after your lifetime. Naming your DAF as the beneficiary of assets provides a flexible way to...

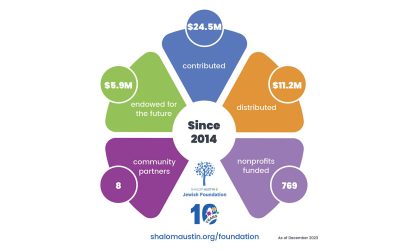

Shalom Austin Jewish Foundation Celebrates 10 Years of Philanthropy

By Allison Teegardin This year marks the ten year anniversary of Shalom Austin Jewish Foundation. Formerly named the Jewish Foundation of Austin & Central Texas, the Jewish Foundation became...

Foundation Fundholders Appreciated for Philanthropic Impacts

Fundholders listen to a presentation at Shalom Austin Jewish Foundation Fundholder Appreciation event at the Dell JCC. Credit: Allison Teegardin By Jennifer Kohn Koppel October 5 was a wonderful...

JEWISH FOUNDATION LEADERSHIP

Jewish Foundation Committee

Chair

Marcia Silverberg, Chair

Marianne Rochelle, Vice Chair

Committee Members

Sandy Dochen

Christina Gorczynski

Jennifer Failla Hoffman

Joel Granoff

Zack Jamail

Lenny Krasnow

Laraine Lasdon

Patti Lengsfield

Lori Levy

Brandon Phillips

Adam Sadovsky

Tracy Solomon

Joe Steinberg

Ex-Officio

Steve Meyers, Shalom Austin Treasurer

Seth Halpern, Shalom Austin Board Chair

Professional Team

Rabbi Daniel A. Septimus, Chief Executive Officer

Amy Hyman, Senior Development Director

Nicole Gilger, Chief Financial Officer

Jennifer Koppel, Foundation Director & Philanthropic Advisor

Mali Estrada, Controller

Founding Committee

Fran Hamermesh

Wade Monroe

Ben Cohen

Dan Kraus

Sandy Kress

Bobby Krumholz

Leone Lain

Joel Levine

Beth McDaniel

Arlene Miller

Janice Pierce

Diane Radin

Pam Reznick

Jay Rubin

Tracy Solomon

Marilyn Stahl (z”l)

Bill Waxman

Susan Zane

As of 5/22/2024

CONTACT US

HEALTH & WELLNESS

Fitness

Swimming

Tennis & Pickleball

Sports

EDUCATION

Jewish Culture & Education

Early Childhood Program Preschool

After School & Childcare

Camps

ARTS & CULTURE

Literary Arts

Visual Arts

Theatre & Film

Dance

COUNSELING & SUPPORT

Jewish Family Service

Counseling & Groups

Case Management

References & Resources

Copyright Shalom Austin 2025. Privacy Policy.